Introduction to Home Improvement Loans

When it comes to renovating your home or undertaking major repairs, financing can be a significant concern. This is where home improvement loans come into play. These loans are specifically designed to provide funds for remodeling, repairs, or upgrades to your home.

Types of Home Improvement Loans

Secured vs. Unsecured Loans

Home improvement loans can be either secured or unsecured. Secured loans require collateral, such as your home, while unsecured loans do not. Secured loans often offer lower interest rates but carry the risk of losing your collateral if you default on the loan.

Personal Loans

Personal loans are unsecured loans that can be used for various purposes, including homeimprovementmix.com/. They typically have fixed interest rates and terms, making it easier to budget for your project.

Home Equity Loans

Home equity loans allow you to borrow against the equity in your home. They usually have fixed interest rates and terms, making them a predictable option for financing home improvements.

Home Equity Lines of Credit (HELOCs)

HELOCs are similar to home equity loans but operate more like a credit card. You have a revolving line of credit that you can borrow against as needed, making them a flexible option for ongoing projects or expenses.

Factors to Consider When Choosing a Home Improvement Loan

Before choosing a home improvement loan, it’s essential to consider several factors to ensure you select the best option for your needs.

Interest Rates

Compare interest rates from different lenders to find the most competitive offer. Lower interest rates can save you money over the life of the loan.

Loan Terms

Consider the length of the loan term and how it will affect your monthly payments and overall costs. Shorter terms may have higher monthly payments but lower total interest paid.

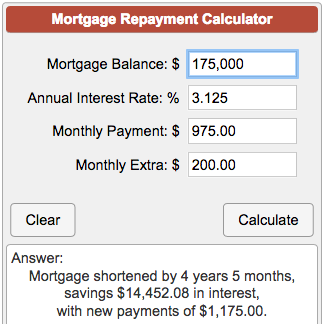

Repayment Options

Look for lenders that offer flexible repayment options, such as biweekly or automatic payments. This can make managing your loan more convenient.

Credit Score Requirements

Check the credit score requirements for each lender and work on improving your credit score if needed to qualify for better rates and terms.

Fees and Charges

Be aware of any fees or charges associated with the loan, such as origination fees, closing costs, or prepayment penalties.

Best Home Improvement Loans Available

Lender 1: Pros and Cons

- Pros: Low-interest rates, flexible repayment options

- Cons: High credit score requirements, origination fees

Lender 2: Pros and Cons

- Pros: No collateral required, quick approval process

- Cons: Higher interest rates, shorter loan terms

Lender 3: Pros and Cons

- Pros: Competitive rates, no prepayment penalties

- Cons: Limited availability, strict eligibility criteria

Tips for Getting the Best Home Improvement Loan

Consider the following tips to ensure you get the best home improvement loan for your needs:

- Improve your credit score before applying for a loan.

- Compare offers from multiple lenders to find the most competitive rates and terms.

- Read and understand the terms and conditions of the loan agreement before signing.

- Consider the future value of your improvements when determining how much to borrow.

Conclusion

Choosing the best loan for home improvement requires careful consideration of various factors, including interest rates, loan terms, and repayment options. By comparing offers from multiple lenders and understanding the terms and conditions of each loan, you can secure the financing you need to make your home improvement dreams a reality.